It is suitable for investors who aim to yield high real return in the medium-long term by investing in companies with high performances in environmental, social, and corporate management areas.

Agesa Hayat Ve Emeklilik Sustainability Equity Pension Fund

Aim to generate real returns by investing in companies listed in the BIST Sustainability Index and/or in internationally recognized sustainability indexes.

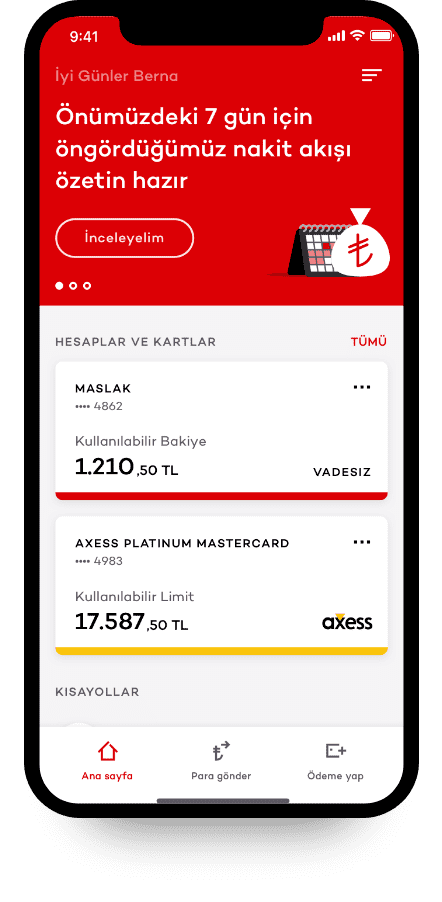

- Ak Asset Management expertise for PPS investment.

- Product range for each risk level.

- Investment opportunity from Akbank and all other banks.

- 0.072693

- %2.79133

- %12.32

- %23.64

- %18.88

- %41.37

- %72.38

- Trend

- Price 0.072693

- Recommended Term 12 Month

- Day %2.79133

- 1M %12.32

- 6M %23.64

- YTD %18.88

- 1Y %41.37

- 2Y %72.38

Fund investment strategy: At least 80% of the fund’s portfolio is continuously invested in: domestic equities included in the BIST Sustainability Index, foreign equities, American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs), and Exchange-Traded Funds (ETFs) that invest in equities included in sustainability indices.The fund aims to achieve high real returns over the medium to long term by investing primarily in companies with strong ESG performance within sustainability indices. “Sustainability investing is generally used interchangeably with the term ESG (‘Environmental, Social, Governance’).”The fund carries macroeconomic, sector, company-specific, and liquidity risks due to its equity investments. Movements in equity markets may significantly affect the fund’s performance. To mitigate risks, diversification is targeted through the selection of equities and ETFs. Up to 50% of the fund portfolio may be invested in foreign currency–denominated money and capital market instruments. 80% or more of the portfolio cannot be continuously invested in foreign currency–denominated instruments. The fund may utilize leveraged instruments for investment purposes and/or hedging. The fund also aims to benefit from market opportunities by using the instruments listed in section 2.4 of its prospectus. The fund’s risk-targeting strategy makes it suitable for all participants in the Private Pension System. To enhance medium- and long-term returns, the fund may invest in higher-risk financial assets and investment funds. The fund’s risk score will be in the 5-7 range

- Trend

- Recommended Term

- 12 Month

Fund Identity

- Fund Manager

- Invested Assets

- Fund investment strategy: At least 80% of the fund’s portfolio is continuously invested in: domestic equities included in the BIST Sustainability Index, foreign equities, American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs), and Exchange-Traded Funds (ETFs) that invest in equities included in sustainability indices.The fund aims to achieve high real returns over the medium to long term by investing primarily in companies with strong ESG performance within sustainability indices. “Sustainability investing is generally used interchangeably with the term ESG (‘Environmental, Social, Governance’).”The fund carries macroeconomic, sector, company-specific, and liquidity risks due to its equity investments. Movements in equity markets may significantly affect the fund’s performance. To mitigate risks, diversification is targeted through the selection of equities and ETFs. Up to 50% of the fund portfolio may be invested in foreign currency–denominated money and capital market instruments. 80% or more of the portfolio cannot be continuously invested in foreign currency–denominated instruments. The fund may utilize leveraged instruments for investment purposes and/or hedging. The fund also aims to benefit from market opportunities by using the instruments listed in section 2.4 of its prospectus. The fund’s risk-targeting strategy makes it suitable for all participants in the Private Pension System. To enhance medium- and long-term returns, the fund may invest in higher-risk financial assets and investment funds. The fund’s risk score will be in the 5-7 range

Months

75% BIST SUSTAINABILITY RETURN + 10% BIST-KYD Repo (Gross) + 15% SP500 ESG Index Total Return Index (AK)